Business value drives decisions. The rule is universal, and applies to every aspect of a business. Even the most promising technology is no exception to this. While there is no doubt about the promise and potential of master data management (MDM), there still exists the need to establish a tangible impact from the lens of business value. The tangible impact, in this case, is return on investment (ROI).

Ask an MDM practitioner about the true business value of the practice, and the result is bewilderment more often than not. Defining ROI on MDM implementation, however, is not as simple as comparing a couple of balance sheets. With multiple variables and contributing factors, businesses often lack the ability to clearly define the scope of assessment.

Read on to get an idea of how to solve the ROI-on-MDM conundrum once and for all.

Crack the “why” before the “what”

What is the pain point you’re looking to solve with MDM implementation? Which area of the business do you expect the practice to impact the most? To measure ROI accurately, you need to have a clear understanding of the metrics that you’re looking to measure. Knowing what you’re looking to measure and where you expect to see impact is critical to defining the scope of measuring ROI on MDM.

MDM implementation is usually an agency of business units (BUs) or corporate IT departments. Looking at the scope of MDM implementations from the BU lens gives a clear scope to the project, since these solutions are targeted at solving specific business problems. Enterprise-wide MDM solutions, on the other hand, are more complex and require greater coordination for success. Defining scope in this scenario becomes that much more challenging.

While large scale MDM solutions have potential for great impact, for the above reason, it is considered prudent to start small and expand from there on in.

Establishing the “I” in ROI

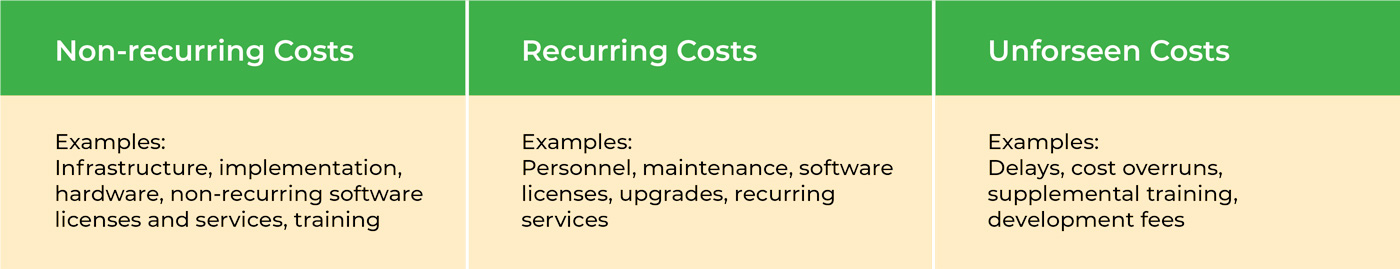

For a business to gauge the return on an investment, it is critical to know what the investment is. Sounds obvious, but many businesses lack the required visibility to make this assessment in the first place. Since MDM solutions are usually scalable, it is not unusual for costs to vary greatly. The primary drivers of cost for most businesses include setup and operational costs. While setup costs usually include licensing, hardware, integration and customization and user training, operational costs are driven by data maintenance.

The above three factors are what businesses usually take into account. However, it is quite common for many to lack the foresight required to factor in delay costs. You must consider the impact on your businesses if you’re not able to implement MDM within the expected timelines.

Understanding cost-benefit analysis (CBA) before taking the dive

A key driver in determining ROI on an MDM system is a thorough cost-benefit analysis that lets you know if the project is worth the spend. This simple equation helps you get a better understanding of the same:

CBA = Expected potential reward – total cost of action.

A positive CBA is desirable, and the higher, the better. The analysis should take into account all cost aspects of implementing and maintaining a project and all related costs resulting from any changes. The analysis should also take into consideration the “cost of inaction” which gives a better perspective on the need and efficacy of MDM.

Build a quantifiable business case

The three primary aspects to take into account when building a business case include:

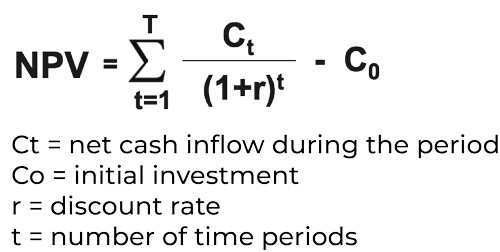

- Net Present Value (NPV): This calculation represents the difference between present value of cash inflows and outflows

- Internal Rate of Return (IRR): The calculation represents the average annual return garnered through the life of the investment. Measured in percentage, the higher the IRR, the higher the value of the project.

- Payback Period: As the name suggests, this calculation measures the duration of time taken to recover investment costs.

Payback Period = Cost of Project/Annual Cash Inflows

Delineate success metrics

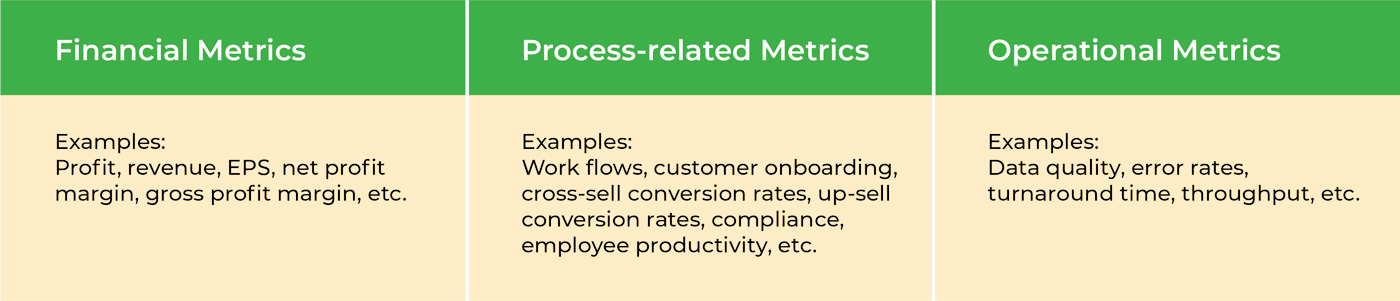

What you define as returns must be a direct and measurable outcome of your MDM initiative. While financial metrics are direct and obvious outcomes that qualify as returns, there also exist numerous derived benefits that can drive financial metrics, albeit indirectly. However, things are not always as straight-forward; almost never in the practice of calculating MDM ROI. You can break it down to financial metrics, however, there are quite a few derived benefits that indirectly drive these financial metrics. They typically include process-related metrics and operational metrics. As you would have noticed, while process-related and operational outcomes may not always have a direct impact on financial impact, they most certainly have a trickle-down effect on the same. The right MDM platform can help you maximize revenue opportunities, cut costs and mitigate risks at every touchpoint of the data journey. These factors have a cumulative effect on ROI, and must be taken into consideration in these calculations.

The financial benefits of MDM practices don’t necessarily make themselves visible in a day. It usually takes a few quarters, if not more, to see the true financial value of a well-oiled MDM initiative. So, if you’re looking to calculate the real ROI on MDM, it is critical not to jump the gun, and to assess initiative efficacy in line with the scope of the project. No doubt, this requires patience, because the value proposition must seep into different levels of the businesses before the fruits are borne.

Follow this space for Part 2 where we’ll discuss how to drive ROI on MDM.